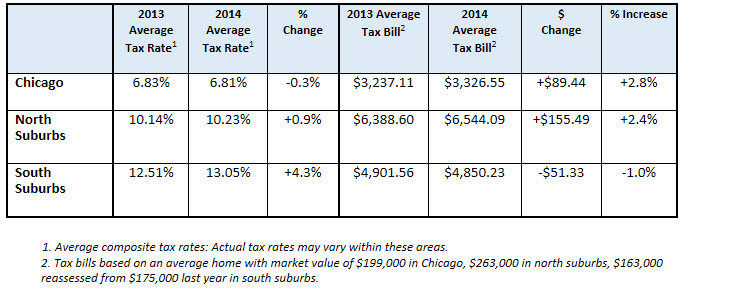

cook county tax portal map

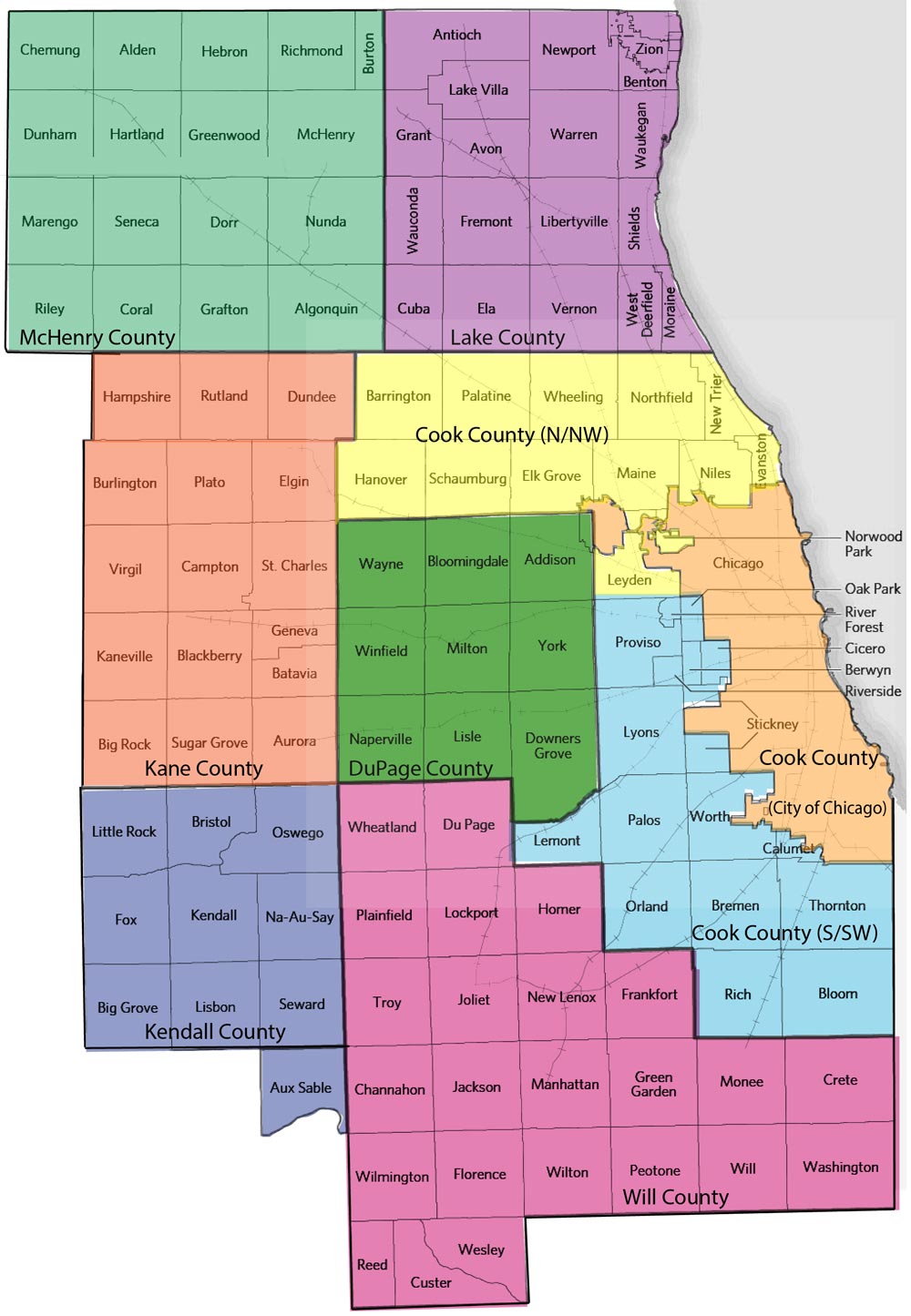

Read The Pappas Study 20-Year Property Tax History. Once you search by PIN you can pay your current bill online or learn.

E Filing Tips Cook County Illinois Legal Aid Online

Begin your search by entering an address property identification numberPIN or intersection.

. Read the Debt Disclosure Report by the Treasurers Office. Cook County Debt Map. Art in the Courthouse.

Mission Geographic Information Systems GIS aims to optimize Cook Countys geospatial investment in information technology through collaboration policy strategic planning and. The Portal consolidates information and delivers. The Department of Revenue is performing planned maintenance on the Cook County Taxpayer Portal.

Cook County Treasurers Office - Chicago Illinois. The Property Tax System. The Portal consolidates information and delivers.

The 2022 Scavenger Sale includes 31209 property index numbers or PINs with 14598 of them in the City of Chicago and 16611 in suburban Cook County. All business can be conducted on. Begin your search by entering an address property identification numberPIN or intersection.

Billed Amounts Tax History. Mission The mission of the Cook County Assessors Office is to serve the public both professionally and responsibly by establishing uniform and accurate property assessments. The county has a wealth of map information that it wants to share with the public.

The Portal will be unavailable today October 7 th from 1200PM to. Tax Extension and Rates The Clerks Tax Extension Unit is. Real Estate Sales Info.

The Cook County Property Tax Portal is the result of collaboration among the elected officials who take part in the property tax system. The Assessor assesses all real estate located throughout the County and establishes a fair market value for each property. The county has a wealth of map information that it wants to share with the public.

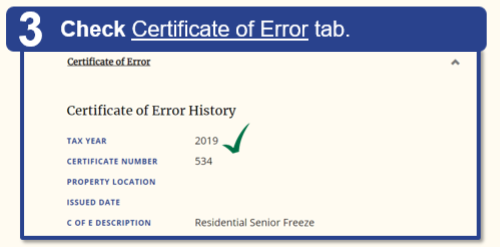

The Tax Assessors Office. Tax Redemption If your unpaid taxes have been sold the Clerks office can provide you with an Estimate of the Cost of Redemption. Search to see a 5-year history of the original tax amounts billed for a PIN.

The Portal will be unavailable today October 7 th from 1200PM to. See the Top 50 Largest Tax Increases since 2000 by Chicago ward and suburb. Centralizing Maps Apps and Data From property and boundary data to transportation social service and environmental data Cook County owns and manages a huge.

The Department of Revenue is performing planned maintenance on the Cook County Taxpayer Portal. Correlation Chart Between Debt and Higher Taxes. Read the Debt Report.

The Cook County Property Tax Portal is the result of collaboration among the elected officials who take part in the property tax system. Read the Executive Summary. Parrish AvenueAdel Georgia 31620 229 896-3665 P229 896-3977 F The Tax Assessors Office provides the following services for Cook County Residents.

On Monday October 10 2022 the office located at 118 N Clark Street Chicago will be closed to the public.

District 14 Cook County Commissioner Britton

Chicago Cityscape Map Of Building Projects Properties And Businesses In District 15 Commissioner Kevin B Morrison Cook County Commissioner District

Property Tax Resources In Chicago Il Sarnoff Baccash

Cook County Property Tax Guide Portal Treasurer Records Search More

2022 Property Tax Bill Assistance Cook County Assessor S Office

We Are Here To Help Cook County Assessor S Office

Cook County Property Tax Portal

3 Things To Know About Cook County Property Taxes By Cook County Assessor Medium

Cook County Homeowners Can Now Check For Tax Bill Delivery Problems News Village Of Hoffman Estates

Cook County Property Tax Bills May Be Delayed By Inter Office Controversy Abc7 Chicago

About The Cook County Assessor S Office Cook County Assessor S Office

Second Installment Cook County Property Tax Bills Delayed Northfield Township